If you have not planned for longevity...we have the solutions.

Planning 4 Longevity provides solutions that secure the impact of living longer, their associated costs and lifestyle implications. The possibility of spending 15, 20 or 25 years or more in retirement should be realistically considered and planned for!

Advances in the field of medicine and improvements in health conditions have led to the trend of longevity.

Click this link to watch a fascinating 5-minute video from the BBC on longevity in 200 countries.

The need for longevity planning:

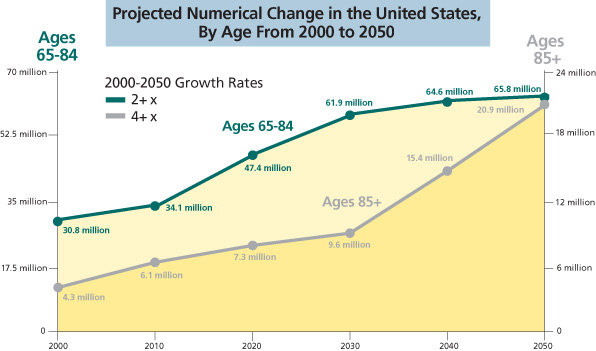

• 80+ age group growing 5x faster than the overall population

• A couple age 65 today: 50% chance one will live to 92 and 25% chance one will live to 97

• We suggest a retirement plan projecting life expectancy to age 100

• People are living longer and we must plan accordingly!

The primary fears of longevity:

• With a volatile stock market, where do I invest protecting against downside market risk but receive a fair return?

• Potential devastating costs of a chronic illness wiping out retirement assets

• Outliving retirement assets and the income needed during retirement

• Being a burden on one's children

• Quality of life during a possibly very long retirement period

If longevity has not been planned for, we have the solutions, including:

• Living Benefits Life Insurance

• Income Term Life Insurance

• Guaranteed Income For Life

• Supplemental Retirement Income

• Single Premium Life Insurance

• Migrating Annuities to Life Insurance

• Long-Term Care Solutions

• College Funding Solutions

• Life Settlements